Employee Expense Management

Managing employee expenses doesn’t need to be complicated. The Trust U Petty Cash Card gives your business a simple, secure, and efficient way to manage employee expenses without relying on cash, shared credit cards, or slow reimbursements. Whether it’s travel, meals, or supplies, this prepaid solution ensures funds are accessible when needed and fully trackable.

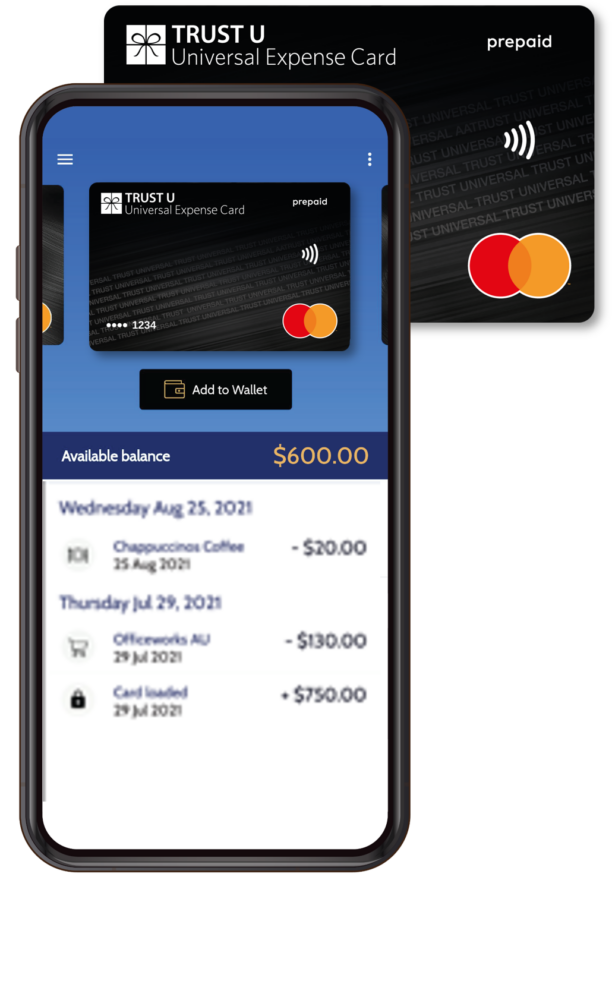

Designed to improve your expense management process, these prepaid Mastercard cards can be issued instantly and managed easily through our secure client portal. There’s no need for a 100-point ID check or linked bank account, making it a fast and flexible option for staff and contractors across Australia.

Benefits of using Prepaid Cards for employee expenses

As businesses look to improve how they manage employee expenses, prepaid cards have become a preferred tool. The Trust U Petty Cash Card offers greater control, faster setup, and better visibility than traditional methods.

Why businesses prefer Prepaid Cards:

No 100-point check required – Set up and issue Digital Prepaid Mastercards the same day, or physical cards sent by post.

Accepted everywhere – Use online or in-store anywhere Mastercard is accepted; optional ATM access.

Peace of mind. Choose where and how cards can be used with merchant restrictions and value limits. See FIT Prepaid for more details.

Track expenses – Access transaction reporting via our client portal for visibility of how company funds are being spent.

Replace petty cash securely – Avoid fraud, loss, or misuse with a safe alternative.

Simplify reporting – Export transactions easily for fast reconciliation and auditing.

Flexible formats – Choose from physical or digital cards depending on your team’s needs.

Save admin time with efficient expense management

Manual processes slow down finance teams and frustrate staff. Our prepaid cards help you manage employee expenses more efficiently by removing the need for reimbursements and simplifying approvals. With the Trust U Petty Cash card, you get:

Instant issue of digital cards for immediate use.

Access to our self-serve client portal for seamless top-ups and card management.

Real-time oversight of all cardholder activity.

Easy card freezing or reloading when needed.

Reduced admin across your entire expense management system.

This is a smarter way to manage employee expenses with complete visibility and control at your fingertips.

How to leverage the benefits of Prepaid Cards across your workforce

Our prepaid cards adapt to all types of employee expense needs. Whether your business runs on the road, on-site, or across departments, you can distribute funds with precision, without the need for a corporate credit card or cumbersome forms.

Common ways businesses use our cards:

Petty cash replacement – Replace physical cash with a tracked, secure alternative.

Travel and transport – Fund fuel, taxis, or transit for employees or contractors.

Staff meals and entertainment – Preload cards for meetings, events, or shift work.

Field teams and remote staff – Give workers the tools they need on the go.

Departmental budgets – Issue cards to managers or teams for discretionary spend.

Contractor or temp support – Provide short-term access without long-term risk.

Need to recognise top performers or boost morale too? Check out our employee rewards for gifting options, or explore our cashback programs to add value to spending initiatives.

Ready to take control of your employee expense process? Let’s talk about how Mastercard, Visa or eftpos prepaid cards can help you streamline your expense management, improve compliance, and reduce admin, while keeping your team empowered and efficient.