Take control with FIT Prepaid

FIT Prepaid simplifies expense management. Choose open-loop cards, accepted anywhere Mastercard is used, or closed-loop cards for specific merchants like fuel stations. Customise spending by setting limits on where, when, and how funds are used.

With FIT Prepaid, you have the power to decide:

- Where funds can be used

- When expenses can occur

- How much can be spent

- How often cards can be used

Smarter spending, greater control, and enhanced security

All powered by Mastercard.

Take control of spending with FIT Prepaid

Looking for a smarter way to manage spending and ensure funds are used exactly as intended? FIT Prepaid, powered by Mastercard, puts you in control with fully customisable solutions tailored to your needs—whether it’s managing incentives, rewards, or specific expenses.

Choose open-loop cards, accepted anywhere Mastercard is valid, or closed-loop cards, restricted to select merchants or categories. Set spending limits, control usage by merchant or location, and even customise when funds can be accessed—all while our Australia-based team manages the logistics. It’s that simple!

In addition to FIT Prepaid, explore other versatile prepaid solutions designed to meet your organisation’s unique needs. From custom generic gift cards to tailored Visa Gift Cards and Christmas Gift Cards, there’s an option for every occasion. Looking to motivate your team? Check out our employee rewards solutions or cashback programs to boost engagement.

Take charge of your spending with FIT Prepaid, putting control firmly in your hands.

Available as a single-load or reloadable prepaid card, you can control:

Where the card can be spent

By a specific merchant or group of merchants, location or terminal.

When it can be used

During low traffic times.

How much can be spent and how often

Including the value of transaction; number of transactions in a time period or a combination of both.

Or any combination of these!

Explore our wide range of cards, delivered your way

Plastic Card

Delivered via post or courier

Digital Card

Delivered via SMS

e-gift Card

Delivered via email

How organisations can use FIT Prepaid

Fund Distribution

Ensuring funds are spent on designated items like transport, groceries and fuel.

Cashback programs

Driving customer acquisition and retention with cashbacks, whilst ensuring funds are spent at specified merchant(s).

Enhance Customer Experience

Providing a branded, easy to use and secure gift card for their specific store(s). Driving customer spend whilst providing an even better customer experience.

Location-Based Promotions

Limiting card use to their LGA to boost tourism and support local businesses.

Claim Management

Reimbursing claims with funds that can only be used merchants relevant to the claim type.

Salary packaging

Ensuring funds are used as intended, avoiding any misuse which can lead to tax implications.

Customer acquisition and retention

Better targeting for marketing campaigns, ensuring funds are used as intended resulting in more effective use of marketing dollar.

Maximise control and efficiency with FIT Prepaid

-

Ensure funds are used as intended

Set limits to prevent overspending. -

Define spending windows

Control when funds can be accessed. -

Targeted spending control

Restrict use by location or merchant. -

Wide acceptance

Use across entire merchant categories. -

Powered by Mastercard

Secure, flexible, and widely accepted.

-

Speed to market

Quick setup, no admin or IT required. -

Customisable designs

Showcase your brand on every card. -

Easy management portal

Manage your cards all in one place. -

Effortless reporting

Simplify tracking and reconciliation. -

Award-winning support

Receive expert help from our Australia-based team.

Benefits for your customers and recipients

Greater utility within the approved merchant category

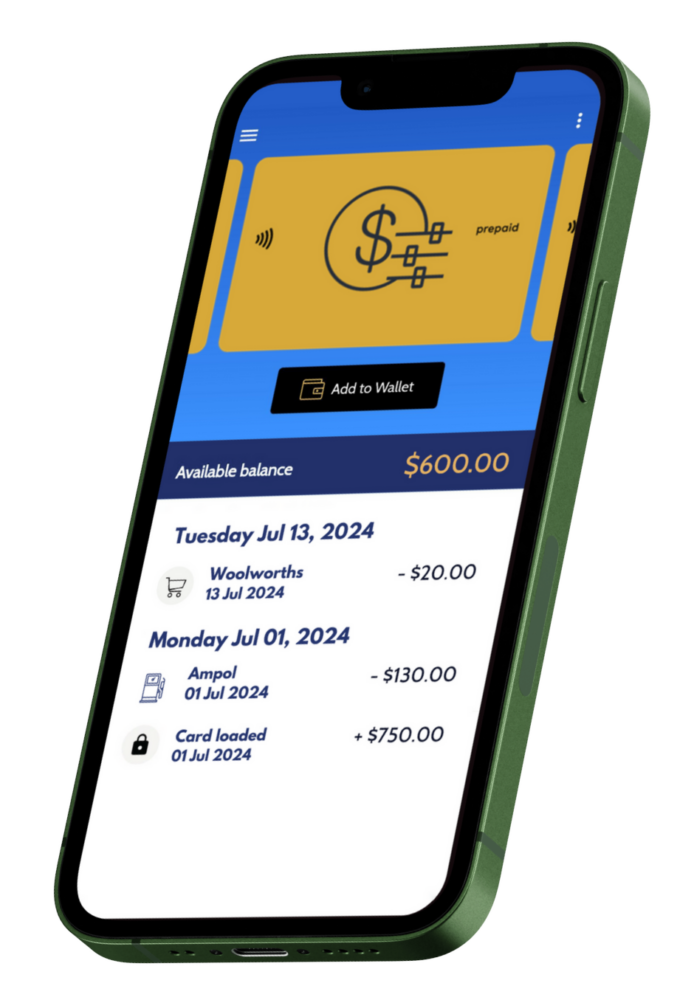

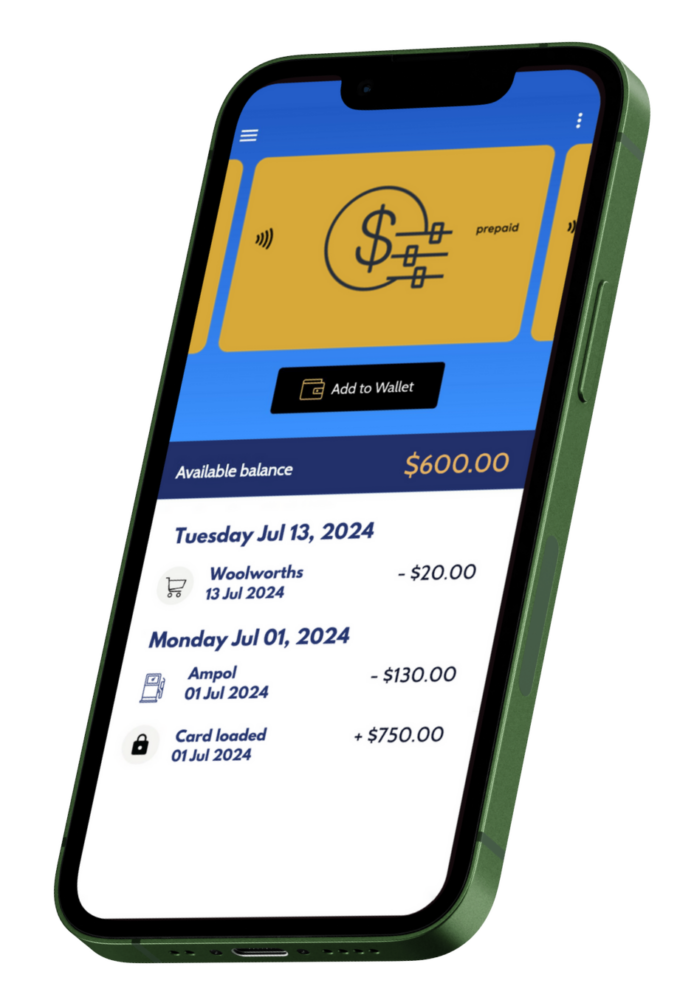

Seamless card activation and management

via our cardholder website and app.

Funds are guaranteed on the card

Lost or stolen cards can be replaced

With store cards, lost or stolen cards are usually unrecoverable

Fraud Protection Guarantee

3DS in place for all transactions, preventing fraud.