The emergence of Digital Cards in the business realm

In an era marked by rapid digitalisation, businesses are constantly seeking innovative ways to streamline operations, enhance security, and provide value to clients and employees.

Digital cards have emerged as a pivotal solution in this transformation, offering a versatile and efficient alternative to traditional plastic cards. Their rise is particularly notable in the business sector, where the need for agile, secure, and convenient transaction methods is paramount.

The evolution of digital transactions

The journey from physical to digital transactions has been a game-changer for businesses worldwide. Digital cards represent a significant evolution in this journey, combining the familiar utility of traditional cards with the added advantages of digital technology. This evolution is not just about convenience, it’s about adapting to the changing expectations of the payment landscape.

What is a Digital Card?

At its core, a digital card functions much like its physical counterpart but exists entirely in a digital format. It can be a digital representation of a prepaid, credit, debit, loyalty, or gift card.

When a business opts for a digital card, it chooses a path of streamlined efficiency and enhanced security. The card information is securely stored in a digital wallet, making transactions swift and traceable.

What is a Digital Wallet?

Digital wallets are essential to the functionality of digital cards. These applications, available on smartphones and other digital devices, store and manage digital card information. The adoption of digital wallets has grown exponentially, with businesses and consumers alike appreciating the convenience and security they offer.

Digital wallets like Apple Pay, Google Pay, and Samsung Pay have become household names, signifying a shift in consumer and business behaviour towards digital payments.

The role of Visa and Mastercard in digital transactions

Visa and Mastercard, two giants in the financial world, have played a crucial role in the adoption of digital cards. Their reputation for security and global acceptance makes them the preferred choice for businesses and individuals alike. Digital cards bearing the Visa or Mastercard logo are not just widely accepted; they are also trusted symbols of reliability and innovation.

The Australian context: A leader in digital adoption

Australia’s embrace of digital payment technologies is world-leading. With a significant portion of the population using digital cards and wallets, the country sets a benchmark for digital adoption.

The Reserve Bank of Australia reported that the share of debit and credit card payments made via mobile wallets has continued to grow in the post-pandemic period, reaching 35 per cent of card transactions in the June quarter 2023, up from 10 per cent in early 2020. Debit card payments are more likely to be made using a mobile wallet than credit card payments.

How can I use a Digital Card for my business?

The application of digital cards in business is vast and varied. They can simplify employee expense management, provide secure transaction options, and serve as a versatile tool for customer and employee rewards.

The flexibility of digital cards, with options for both single-load and reloadable configurations, allows businesses to tailor their use to specific needs, be it for one-off requirements such as corporate gifts, or ongoing requirements such as staff expenses.

When ordering Digital Prepaid Mastercards from a provider like Corporate Prepaid Cards, your business can easily order and load funds onto Digital Prepaid Mastercards via an online client portal. Load a single amount onto a prepaid gift card to benefit a client, customer or employees, or provide regular top-ups for employee expense cards, ongoing incentives or commissions.

What are the benefits of Digital Cards for businesses?

Enhanced security and control: Digital cards offer advanced security features, including encryption and tokenisation. They reduce the risk of fraud and unauthorised use, providing businesses with greater control over financial transactions.

Customisation and branding opportunities: Businesses can customise the design of digital cards, incorporating their branding and messaging. This customisation enhances brand visibility and recalls every time the card is used.

Streamlined expense management: Digital cards enable businesses to set and adjust spending limits, track expenses in real-time, and streamline the expense reporting process.

User-friendly interface: The cardholder apps associated with digital cards offer functionalities like easy activation, balance checks, and transaction history. These features simplify the management and reconciliation of business expenses.

Quick and efficient distribution: Digital cards can be distributed instantly via email or SMS, making them ideal for remote teams or instant reward programs.

Global acceptance and versatility: Being compatible with a wide range of retailers and services globally, digital cards offer unparalleled flexibility and convenience for users.

Digital Cards in Employee Rewards and Recognition Programs: In the realm of employee rewards and recognition, digital cards offer a modern and flexible solution. They can be used to acknowledge employee achievements, celebrate milestones, or incentivise performance. The immediacy and practicality of digital cards make them an appealing option for businesses seeking to foster a positive and motivating work environment.

How do Prepaid Gift Cards work, and how can I use them for my business?

Prepaid gift cards from Corporate Prepaid Cards are available as Visa or Mastercard. Accepted in 37 million retailers worldwide, instore and online, they offer ultimate flexibility and are used by businesses Australia-wide to:

● Manage and track staff expenses: Prepaid digital cards are loaded with a selected amount of money. You can set spending limits and limit transactions to certain purchases.

This is perfect for tracking and managing staff expenses. Ensure your staff are spending company money on necessary transactions, not frivolous luxuries.

● Reward employees: Corporate Prepaid Cards provide clients access to their online portal making card management easy and saving time for businesses.

Your business can incorporate prepaid gift cards with employee incentives, bonuses and gifts. Incentive solutions are made easy with reloadable prepaid cards.

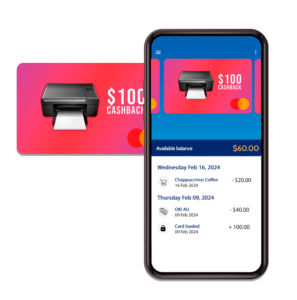

● Reward customers: Rewarding your customers will drive customer loyalty, encourage repeat purchases and sustain longevity for your business. A current trend that is incorporated into digital cards is cashback rewards, an incentive loved by customers.

● Eliminate cash and improve security: More and more businesses and consumers are using digital cards and digital payments, keeping them safe whilst protecting their money from fraud and theft.

● Provide corporate gifts for clients, customers and employees: Entice clients, encourage customers and reward employees with prepaid gift cards, usable for almost any purchase globally.

Corporate Prepaid Cards offers a range of Prepaid Gift Cards that are also available as Digital Cards so your cardholders can easily push their prepaid card to their preferred digital wallet. Their prepaid cards include:

- Mastercard E-Gift Cards are delivered the same-day via email, single-load E-Gift Cards are perfect for recipients working from home or remotely. All you need is their email address and the prepaid card will be sent directly to their inbox, ready for them to add to their Apple Pay, Google Pay or Samsung Pay wallet to spend instore or online.

- Plastic Mastercard Prepaid Cards are delivered via post or courier and are available as a Plastic and Digital Card Dual Package. This means you can choose to have the best of both worlds. Perfect for recipients who prefer plastic cards but would also like the option to use their card from their phone wallet. Available as single-load and reloadable.

The future of business transactions with Digital Cards

As we look towards the future, it’s evident that digital cards will play an increasingly significant role in business transactions. They offer a blend of efficiency, security, and adaptability that is well-suited to the dynamic nature of modern business.

Whether it’s managing expenses, rewarding employees, or engaging with customers, digital cards provide a versatile and future-proof solution.

Embracing digital innovation

The shift towards digital cards is more than a technological trend; it’s a reflection of the evolving needs and preferences of businesses and consumers. By embracing digital cards, businesses position themselves at the forefront of innovation, ready to meet the challenges and opportunities of the digital age.

For organisations seeking to streamline their financial operations, enhance security, and offer value to stakeholders, digital cards are an indispensable tool.

For comprehensive solutions and expert guidance on integrating digital Mastercard cards into your business strategy, reach out to Corporate Prepaid Cards. Our Australia-based team is dedicated to helping you navigate the digital landscape with confidence and success.