Managing worker expenses is a crucial part of running a construction business. Effective expense management is more important than ever, with construction company insolvencies about to reach an all-time high. Worker expenses are just one piece of the financial puzzle but streamlining them is a straightforward way to work toward better financial planning.

However, by implementing efficient processes, businesses can gain better control over costs, enhance financial transparency, and improve overall project profitability. Whether you are a construction project manager, a business owner, or involved in the financial aspects of building projects, this article will provide valuable insights and actionable advice to enhance your expense management.

We will explore the significance of managing worker expenses, explore the challenges faced by construction businesses, and provide valuable tips to streamline expense management. We will also discuss strategies for tracking and monitoring worker expenses, specifically through the use of petty cash cards, and share practical tips to optimise expense management workflows.

Common challenges in managing worker expenses

Managing worker expenses on construction sites can present various challenges for businesses. But without addressing these obstacles, construction companies struggle to fund new projects, buy new materials, and keep up worker morale. In part, this contributes to the high insolvency rate in construction, with building businesses taking 27% of the total insolvency appointments in Australia.

Cash management

Cash management issues can arise when construction workers are paid in cash, making it difficult to track and reconcile expenses accurately. This lack of transparency can lead to financial discrepancies and hinder financial planning.

Expense tracking

Construction projects involve multiple workers, subcontractors, and various expense categories, making it difficult to accurately record and monitor expenses. In the end, it can lead to misallocated costs and prevent effective project budgeting.

Expense visibility

Lack of visibility into expenses can impede decision-making and resource allocation. Without a clear overview of expenses, businesses may struggle to identify cost-saving opportunities and optimise project budgets effectively.

Site managers cannot get a clear view of expenses without utilising technology. The traditional system involves workers paying for goods, then reporting the information back to management. However, this relies heavily on trust and accurate reporting.

Budget and tracking applications can give managers a direct and clear view into expenses, allowing them to accurately monitor expenditures, categorise them efficiently, and spot room for improvement while saving time.

Late reimbursements

Late reimbursements can cause frustration among workers, impacting their morale. Delays in reimbursing expenses can create financial strain for workers, too, affecting their job satisfaction. Eventually, this can lead to productivity issues, or worse, poor employee retention.

Fraud and financial errors

Finally, the risk of fraud and errors is a significant concern. Inadequate controls and monitoring mechanisms can leave businesses vulnerable to fraudulent expense claims, leading to financial losses and damaged trust.

Addressing these challenges requires a streamlined expense management system, leveraging technology for more accurate tracking. Now that it’s 2023, there are more ways than ever to overcome the difficulties of expenses management through technology.

Best practices for managing construction expenses

Implementing best practices for managing construction expenses is crucial for maintaining financial control and ensuring compliance. Here are some valuable tips and guidance.

1. Establish clear expense policies

Having clear policies in place is essential for managing construction expenses effectively. Make sure you clearly define expectations for your workers, outline acceptable expenses, and establish approval processes to ensure adherence to your policies.

2. Educate workers on proper expense management

Educating workers on proper expense management is crucial. Communicate your expense policies effectively, preferably with written guidance they can refer back to. You may need to provide training, especially to site managers who can ensure processes are followed. By promoting awareness and understanding, workers are more likely to follow established procedures.

3. Leverage tools for streamlined expense management

Don’t be afraid to utilise tools and software designed for streamlined expense management. Some software programs can automate expense reporting processes, eliminate manual paperwork, and reduce administrative burdens, all contributing to better expense management. By leveraging technology, businesses can vastly improve efficiency and accuracy in managing construction expenses.

4. Conduct regular audits and expense reviews

Regular audits and reviews are vital to ensure compliance and detect irregularities. Every so often, you should perform periodic audits to verify policy adherence and conduct thorough reviews of expense reports. This helps identify accidental errors, potential fraud, or policy violations. The more often you do this, the more likely it is that you will catch errors early and be able to correct them swiftly.

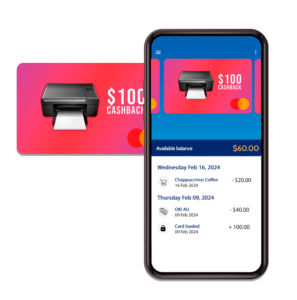

5. Utilise the Corporate Prepaid Gift Cards online portal

With a Corporate Prepaid Gift Card, you get access to the online portal. Here, it’s easier than ever to streamline expense tracking and reporting for tax purposes. You can use the portal’s features to facilitate efficient expense management, including tracking, reconciliation, and reporting. With access to this data, it simplifies expense management, ensures accurate records, and gives you improved financial control.

Corporate cards and construction expenses

Corporate prepaid cards can offer valuable solutions to help you manage worker expenses on construction sites. With a single load card, employers can load up set expenses and distribute the cards to workers, setting an established budget for expenditures while also providing a way to track expenses without the need for traditional reporting.

They differ from traditional gift cards because they are accepted anywhere that accepts Mastercard, Visa, or Eftpos, which means they’re perfect for use by site workers. Plus, with links to tracking applications, they provide numerous benefits for expense management, including improved visibility, reduced errors, and faster reimbursements.

A reloadable TRUST U petty cash card is a great way to implement corporate cards for workers who might not otherwise meet your requirements, and it can provide excellent benefits for your business.

Firstly, businesses can enhance expense tracking and gain real-time insights into expenditures. Corporate cards enable businesses to monitor and categorise expenses accurately, eliminating the need for manual cross-checking. Ultimately, this saves time and also reduces the risk of errors.

Corporate cards also streamline the reimbursement process, ensuring faster reimbursements for workers because businesses know exactly what has been spent. It alleviates financial strain and boosts worker satisfaction, enhancing productivity.

It’s easy to manage a variety of expenses with corporate payment cards, including:

- Fuel expenses for company vehicles

- Meals and catering during work hours

- Equipment rentals and purchases

- Office supplies and materials

- Travel and accommodation expenses

- Maintenance and repair costs

- Training and certification fees

- Subcontractor payments

- Utility bills (e.g. electricity, water)

- Parking fees and tolls

- Professional services (e.g. legal, consulting)

- Safety equipment and gear

- Technology and software subscriptions

- Advertising and marketing expenses

Setting up card programs is a relatively simple process. With Corporate Prepaid Gift Cards, all you need to do is fill out a form to get a quote. You will need to determine spending limits that align with specific roles and responsibilities, and establish usage guidelines to outline approved expenses.

Visit our Mastercard Prepaid Gift Card , Visa gift card, or Eftpos gift card pages for more information.

Learn more about managing worker expenses: