Prepaid Cards for First Nations Organisations

Looking for a secure, efficient alternative to cash, store cards, or purchase orders? Prepaid cards for First Nations organisations are designed to streamline fund distribution and administration.

Developed in consultation with key industry participants, our bespoke Visa Gift Cards, Mastercard Gift Cards, and FIT Prepaid Cards simplify secure fund allocation and reconciliation. Save time on administration so you can focus on what truly matters to your organisation.

What are Prepaid Cards for First Nations Organisations?

Prepaid cards for First Nations organisations provide a secure, efficient, and transparent solution to manage and distribute funds. Designed to address the unique challenges faced by Indigenous service providers, these cards—such as Prepaid Visa Gift Cards, Mastercard Gift Cards, and FIT Prepaid Cards—offer a reliable alternative to cash, simplifying fund allocation while ensuring compliance and accountability.

Many First Nations organisations face challenges with traditional fund distribution methods, including:

- Risk of misuse or loss – Cash handling increases the potential for theft or improper use.

- Limitations on usage – Store-specific vouchers restrict where funds can be spent, especially in remote locations.

- Lack of transparency – Tracking and auditing cash transactions can be difficult.

- Complex administration – Managing receipts, reimbursements, and reconciliation is time-consuming.

- Time-intensive processes – Ensuring staff and members have access to funds requires extensive resources.

- Emergency fund delays – Traditional methods often lack the speed needed for urgent financial assistance.

By replacing cash and traditional methods, prepaid cards save time, enhance security, and streamline processes for First Nations organisations—whether for emergency support, everyday purchases, or operational expenses.

How can Indigenous Service Providers use prepaid gift cards?

Prepaid cards offer versatile and effective applications for First Nations organisations, helping them streamline operations and meet their communities’ needs:

Secure and fast fund distribution

Same-day Digital Prepaid Mastercards, delivered via SMS, ensure immediate assistance to funds to cover urgent necessities like food, lodging, or essential services. They eliminate postage delays, making them ideal for remote regions.

Simplified reporting

Enjoy seamless reporting through our Client Portal, with transaction exports aligned to cost codes and expenditure categories, saving time and ensuring compliance.

Peace of mind

Optional merchant blocking prevents misuse, restricting purchases on items like alcohol or gambling, giving organisations confidence that funds are spent as intended.

Streamlined staff expense management

Reloadable petty cash cards ensure staff always have funds for work-related expenses. Manage balances and automate top-ups through the portal, avoiding reimbursement delays.

First Nations organisations are not alone in benefiting from prepaid card solutions. At Corporate Prepaid Cards, we design prepaid card programs that meet the specific needs of organisations across industries. From driving efficiency and accountability for NDIS providers to supporting universities with grant distribution and helping healthcare providers enhance patient and staff support, our prepaid card solutions adapt to diverse operational goals, ensuring effectiveness and flexibility.

Ensure security with Trusted Leaders in Digital Payments

- Reduce risk. Prepaid Mastercard and Visa Gift Cards offer a secure alternative to cash. Lost or stolen cards can be suspended and replaced.

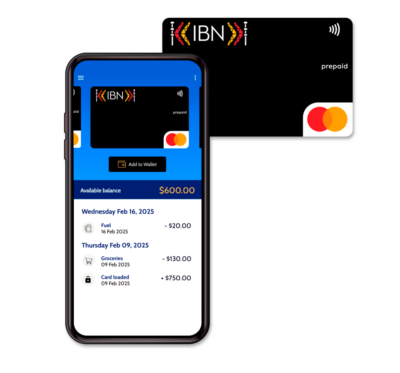

- Ensure funds are used as intended. Control when, where and how funds can be spent with FIT Prepaid.

- Easy ordering and transparent reporting. Organisations can order, load and manage their prepaid cards via our Client Portal. With real-time reporting.

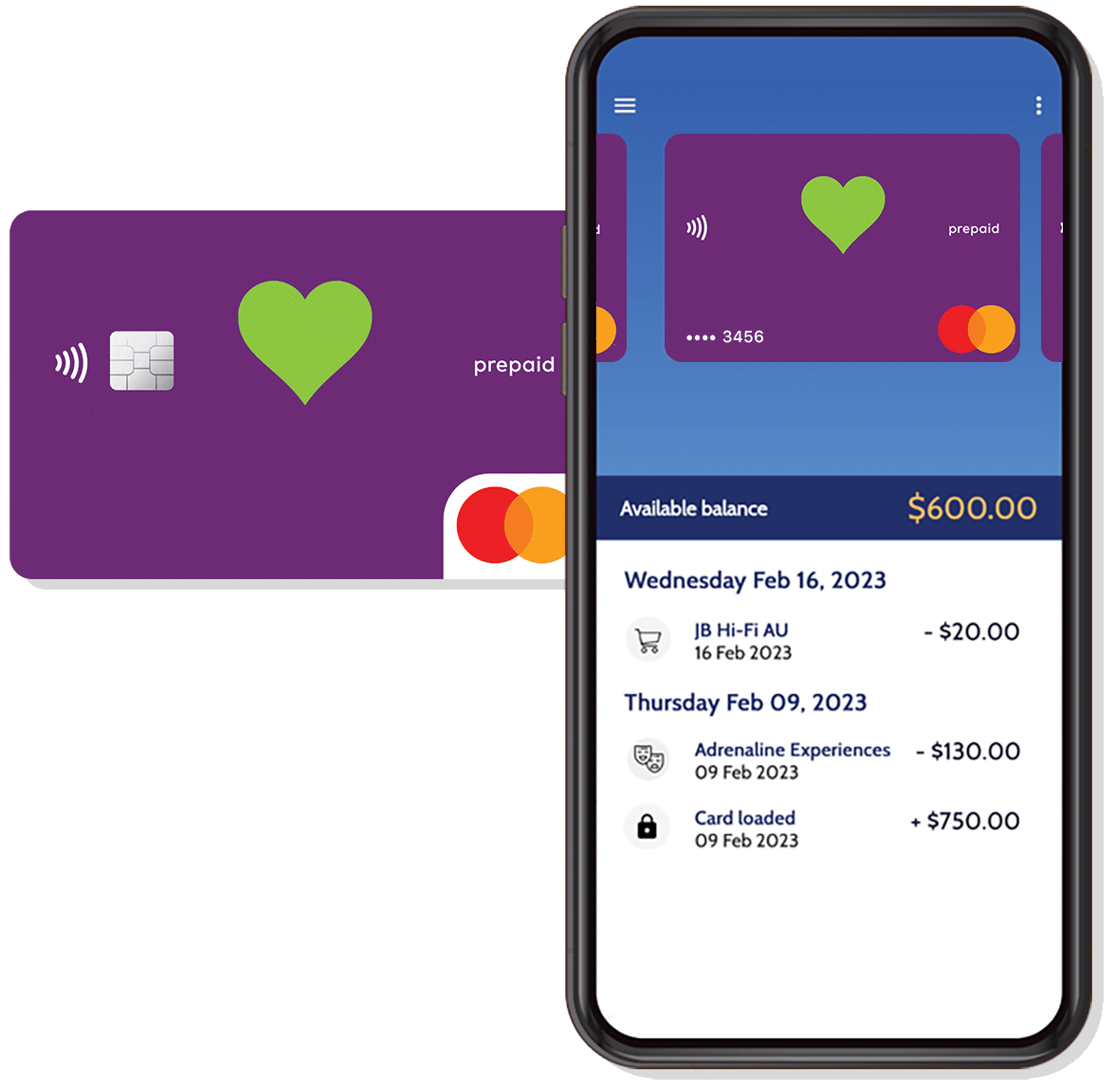

- Immediate access to funds. Recipients can activate in minutes and manage their card via our cardholder website or app.

- Wide acceptance. Recipients can use their funds online or in-store anywhere that accepts Mastercard or Visa.

- Secure. If the prepaid card is suspected to be lost or stolen, cardholders can easily suspend their card to prevent further misuse.

Why Indigenous Service Providers choose Prepaid Gift Cards

-

Flexible card options

Tailored to your organisation’s needs, choose from Prepaid Mastercard, Visa Prepaid Cards, and FIT Prepaid Cards in physical, digital, or combined formats. Optional ATM access offers additional convenience.

-

Fast fund distribution

Quickly distribute funds with same-day delivery options, including SMS-delivered digital cards or email-delivered cards. Available as single-load, reloadable, or zero-balance for future top-ups.

-

Secure cash-free solution

Eliminate the risks of cash handling with secure prepaid cards. Simplify administration, reduce inefficiencies, and enable staff to focus on delivering vital services.

-

Streamlined staff expenses

Simplify staff-related costs with reloadable petty cash cards. Monitor balances, automate top-ups, and eliminate reimbursement delays.

-

Wide acceptance with spending controls

Clients can use Mastercard and Visa Prepaid Cards at over 37 million global retailers or eftpos cards across Australian stores.

-

Ensure funds are spent as intended

Support responsible spending with FIT Prepaid's control features - control where, when and how funds can be used. Automatically block purchases for alcohol, gambling, and tobacco to ensure appropriate fund management.

-

Real-time expense monitoring

Gain instant visibility into spending with real-time reporting and exportable data, making expense tracking and reconciliation seamless.

-

Branded card options

Highlight your organisation’s identity with branded prepaid cards. Simply add your logo or customise with your organisations design.

-

Fraud Protection Guarantee

Our fraud prevention safeguards funds, giving organisations and recipients peace of mind.

Flexible card options

Tailored to your organisation’s needs, choose from Prepaid Mastercard, Visa Prepaid Cards, and FIT Prepaid Cards in physical, digital, or combined formats. Optional ATM access offers additional convenience.

Fast fund distribution

Quickly distribute funds with same-day delivery options, including SMS-delivered digital cards or email-delivered cards. Available as single-load, reloadable, or zero-balance for future top-ups.

Eliminate cash: With our prepaid card solution, your organisation will no longer have to deal with cash and can enjoy reduced administration and risk. Drive efficiency and support your staff in delivering their services with ease.

Mastercard and Visa Prepaid Cards are accepted at over 37 million retailers both in-store and online, with optional merchant blocking. This helps ensure that funds are being used effectively by clients and members.

Easily track spending: Real-time reporting allows organisations to monitor and audit how funding has been spent.

Branded card design options: Choose from our range or create custom prepaid cards, branded for your organisation.

Fraud protection guarantee.