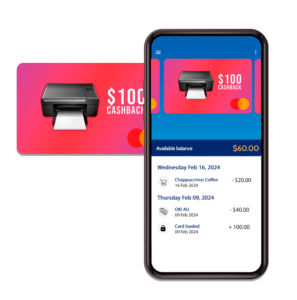

Switch from petty cash to secure prepaid expense cards

Manage employee expenses without the risks of petty cash and save time and money! The TRUST U Petty Cash Card is a convenient, secure and efficient way to manage employee expenditure related to work activities. The TRUST U Petty Cash Card gives your employees a smart and easy way to pay for expenses and you will realise a reduce in employee expenses by 20% to 35%!

What is TRUST U Petty Cash Card?

The TRUST U Petty Cash Card is a reloadable prepaid VISA card designed to cover minor work-related expenses for employees who don’t meet the criteria for a corporate credit card. The TRUST U Petty Cash Card is intended for occasional expenses related to work activities, such as taxis, parking fees, fuel and expenditure associated with projects such as meetings, functions and incidental supplies.

Why use TRUST U when staff expenses have always been paid with cash and then claimed back?

The TRUST U Petty Cash Card is a superior solution for work-related employee expenses because it allows you to set the budget and the employee cannot overspend – an advantage for both employers and staff. The TRUST U Petty Cash Card has all the convenience and security of a credit card with the additional benefit of budget control.

How does the TRUST U Petty Cash Card work?

The employer sets up the card with a fixed amount that can be topped up at intervals. The employee uses it to pay for incidental expenses that previously they would have paid for themselves and later claimed back through petty cash.

TRUST U Petty Cash Cards have the intrinsic benefit of building trust with employees that encourages their accountability and commitment to the company. Loyalty to the business is an intangible asset that can be encouraged with benefits for employees. Making the expense claim process stress-free builds confidence and boosts staff commitment by recognising their autonomy and trust.

Easy to set up, establish the balance and activate by the employee, it can be topped up only by the company through the secure online portal.

Does the TRUST U Petty Cash Card have ‘tap-and-go’ technology like a credit card?

Yes, with the TRUST U Petty Cash Card, minor expenses can be paid instantly with the contactless technology of VISA payWave. If the expense is under $100, just tap and go! TRUST U can be used in any store where VISA prepaid is accepted in Australia or overseas, including purchases made online.

Does the TRUST U Petty Cash Card have tax implications?

No. The TRUST U Petty Cash Card does not incur Fringe Benefit Tax (FBT) and has an Australian Tax Office Class Ruling 2014 / 26. You can read the details on the ATO website.

What are the benefits for employers by using the TRUST U Petty Cash Card instead of petty cash?

Employers prefer the prepaid card system because it:

- Maintains budgetary control, saves time and costs.

- Eliminates paperwork as there is no need for receipts, reconciliations, substantiation or reimbursements.

- Shows the card balance and transaction history via a secure online portal.

- Features your company logo or a branded custom design so your company is the focus of the card.

Do employees prefer TRUST U Petty Cash Card?

Employees appreciate the convenience of the prepaid card because:

- They don’t have to use their own cash or credit card.

- It is easy to use, with ‘tap-and-go’ functionality.

- They don’t need to fill out forms to be reimbursed.

- It promotes an element of trust between employer and employee.

Who provides TRUST U Petty Cash Card?

TRUST U Petty Cash Cards are provided by Zenith Payments, Australia’s leading payments processing and prepaid card provider, used by 300 of the top 500 companies. A 100% Australian owned company, Zenith specialises in the provision of prepaid Mastercard, VISA and eftpos cards to corporates for employee expenses, staff recognition programs, customer acquisition and retention programs.

To find out more, visit the Corporate Prepaid Cards website here.

Photo Credit @rawpixel