When searching for the right prepaid card for your business, comparing Visa vs Mastercard and eftpos can be confusing. To alleviate this confusion, our comprehensive guide is here to offer you a comparison of each option. Say goodbye to uncertainty and make an informed choice with our expert insights.

The Different Prepaid Gift Cards

EFTPOS prepaid cards

EFTPOS stands for “Electronic Funds at Point of Sale”. It’s Australia’s most popular payment system, making eftpos facilities widely available for purchases.

With an eftpos prepaid card, funds can be preloaded onto the card offering businesses a convenient and secure way to provide staff rewards, incentives, prizes, thank you gifts and much more. These cards are connected to the eftpos network, ensuring smooth transactions at any store, anywhere in Australia with an eftpos terminal.

Benefits of eftpos prepaid cards:

- A versitile alternative to cash. With an eftpos prepaid card, you can load funds onto the card and use it for transactions without the need for carrying cash, eliminating the risk of losing physical money.

- Security. Prepaid cards provide enhanced security compared to carrying cash. If your card is lost or stolen, you can quickly report it to the provider and have it deactivated, protecting your funds from unauthorised use. Some cards may also offer additional security features such as PIN protection or fraud monitoring.

- Budgeting and control. Eftpos prepaid cards allow you to set a specific budget by loading only the desired amount onto the card.

Drawbacks of eftpos prepaid cards:

- Some limitations in acceptance. While eftpos prepaid cards are widely accepted within stores in Australia, they cannot be used online.

- No ATM access. Due to eftpos prepaid cards only being accepted in stores with eftpos terminals, they cannot be used at an ATM to withdraw funds.

However, these drawbacks are offset by eftpos typically being a lower cost prepaid card solution compared to Mastercard and Visa.

Mastercard and Visa Prepaid Cards

Mastercard prepaid cards and Visa Prepaid Cards offer a secure, convenient and easy way to manage staff expenses, corporate gifts, commissions and incentives, disruption payments and much more. These cards are preloaded with funds, ready to spend in 37 million worldwide retailers, in-store and online.

Benefits of Mastercard and Visa Prepaid Cards

- Wide acceptance. When comparing eftpos vs Mastercard and eftpos vs Visa, a key difference is Mastercard and Visa Prepaid Cards are accepted instore and online, worldwide.

- Safer payment option than cash. If your card is lost or stolen, you can quickly report it to the provider and have it deactivated, safeguarding your funds from unauthorised use. Many cards come with additional security features such as chip technology and PIN protection to enhance transaction security.

- Controlled spending compared to credit cards. You can load the desired amount onto the card, helping you stay within your budget and avoid overspending. This makes them particularly useful for budgeting purposes, travel expenses, managing allowances, or as a substitute for company credit cards.

- Streamlined expense management. Minimising administration and paperwork, saving time and money.

Drawbacks of Mastercard and Visa Prepaid Cards

- Fees may apply. Depending on whether your business requires single-load or reloadable prepaid cards, there may be fees associated such as reloads and transaction fees.

- Load limits. Prepaid Card providers may have different load limits per card. However some providers offer great flexibility with their load limits.

Overall, Mastercard, Visa and eftpos prepaid cards offer a convenient, secure, and widely accepted solution that can empower your business to manage your finances with flexibility and control. Whether for corporate gifting, staff expenses, incentives or commissions and reimbursements, prepaid cards are sure to benefit your business.

Corporate Prepaid Cards. Australia’s Leading Provider Of Prepaid Cards.

At Corporate Prepaid Cards, our dedicated Australia-based team have been helping clients find the perfect prepaid card solution for their business needs since 2005.

With our wide range of eftpos, Visa and Mastercard Prepaid Cards, we would love to help your business too.

Read more to discover our wide range of eftpos, Visa and Mastercard Prepaid Cards; available as Plastic Cards, Digital Cards (SMS delivered) or E-Gift Cards (email delivered).

Choosing The Right Prepaid Card For Your Business

At Corporate Prepaid Card, we understand the importance of choice. Whether you require prepaid cards for a single event or for ongoing business purposes, we have the perfect solution tailored to your needs. Our prepaid cards offer the flexibility of loading funds once or multiple times, enabling your recipients to use them seamlessly at retailers instore (eftpos) or in over 37 million retailers, online and instore (Visa and Mastercard).

Design options

We offer a range of design options including:

- Pre-designed cards that are ready to order.

- Logo overprint which involves placing your logo on a pre-designed card

- Or, fully customise with your branded design for maximum impact.

Here’s the run-down of the different eftpos, Mastercard and Visa cards we offer.

Visa, Mastercard And Eftpos Plastic Cards

Plastic prepaid cards are great for tangible corporate gifts, incentives or commissions, or providing prepaid cards to recipients who prefer physical cards.

Our plastic prepaid cards are available as eftpos, Visa and Mastercard. Key differences in our plastic prepaid card range includes:

Eftpos plastic prepaid cards

- Available as single-load only

- Accepted in any store across Australia

- Spending power up to $1,000

- Choose from our pre-designed card range, logo overprint or fully customise with your brand.

Mastercard plastic prepaid cards

- Available as single-load, reloadable cards or zero balance cards (buy now, load later).

- Accepted in over 37 million retailers, instore or online

- Spending power up to $9,999

- Optional compatibility with Apple Pay, Google Pay and Samsung Pay.

- Optional ATM access.

- Choose from our pre-designed card range, logo overprint or fully customise with your brand.

- Available as single-load and reloadable cards.

- Accepted in over 37 million retailers, instore or online.

- Spending power up to $9,999

- Choose from our pre-designed card range, logo overprint or fully customise with your brand.

- Optional ATM access.

Mastercard E-Gift Cards are a single-load prepaid Mastercard that is emailed the same-day to your recipients. Choose between:

- Emailed cards. Can be spent anywhere online that accepts prepaid Mastercards.

- Wallet enabled emailed cards. Received by email and easily added to a phone wallet. Can be spent instore and online.

With fast email delivery, you can use E-Gift Cards for:

- Last-minute prepaid cards

- Apologies or resolutions for customer complaints

- Renewal, subscription and reactivation campaigns

- Recipients who are located in remote areas and regularly purchase online

- Ad-hoc or one-off employee purchases

- Staff and client gifts

For businesses, our Mastercard E-Gift Card is a great option because:

- Fully customise with your brand. Choose from our range or our Design Team can design your custom package for you.

- Low or no administration. Simply order via our self-serve client portal and we take care of the test.

- Fast. Once payment is received, your E-Gift Cards will be sent the same day.

- Spending power. You can load up to $1,000 per card.

Recipients can also enjoy:

- Universal acceptance. Recipients can use anywhere Mastercard is accepted online. Phone-wallet option for instore spending.

- Secure. Recipients don’t have to carry cards in their wallet

- Better than a retailer card. More choice and flexibility.

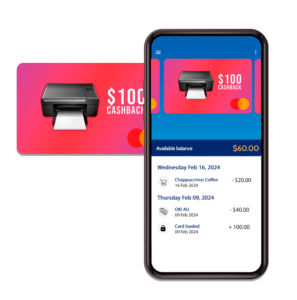

Delivered the same-day* via SMS and compatible with phone-wallets, our Digital Prepaid Mastercard’s offer ultimate flexibility and ease of use for clients, partners or staff. Recipients can easily add their digital card to their Apple Pay, Google Pay or Samsung Pay wallet, and spend anywhere instore or online.

Clients prefer our digital cards for:

- Employee gifts celebrating company tenure milestones or high achievement awards

- Budgeting petty cash, employee reimbursement or specific project expenses, by using our Trust U Petty Cash Card

- Powerful marketing to drive customer-desired behaviour, including survey completion and testimonials

- Convenient and secure payment method for sales commissions and bonuses

For businesses, our Digital Prepaid Mastercard Card is a great option because:

- Secure and same-day delivery via SMS to the recipient’s mobile.

- Choice. Available as single load and reloadable.

- More spending power compared to our E-Gift Card. Load up to $9,999 per card

- Optional dual package which enables recipients to have a digital card and plastic card connected to the same account. Perfect for those who want multiple options for funds access.

- Your fully customised digital card design in your recipients’ mobile phone wallet. Every time they use their card, they will be reminded of your brand.

- Easy ordering from the self-serve client portal with no minimum card quantity or value.

Recipients can also enjoy:

- User-friendly app. Allowing easy card activation, adding to Apple Pay, Samsung Pay or Google Pay wallets with instant access to check balance.

- Recipients can use their Digital Prepaid Mastercard wherever Mastercard Prepaid cards are accepted, instore and online. With over 37 million locations where Mastercard is accepted, the Digital Prepaid Mastercard provides endless choice.

About The Author

Corporate Prepaid Cards is owned by Zenith Payments. We are Australian and privately owned company. We have been selling Visa, Mastercard and eftpos gift cards since 2005, issuing 750,000 prepaid cards per annum, with a turnover of over $2.5 billion.